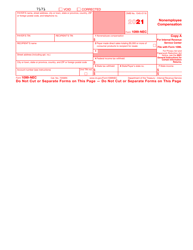

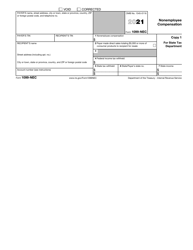

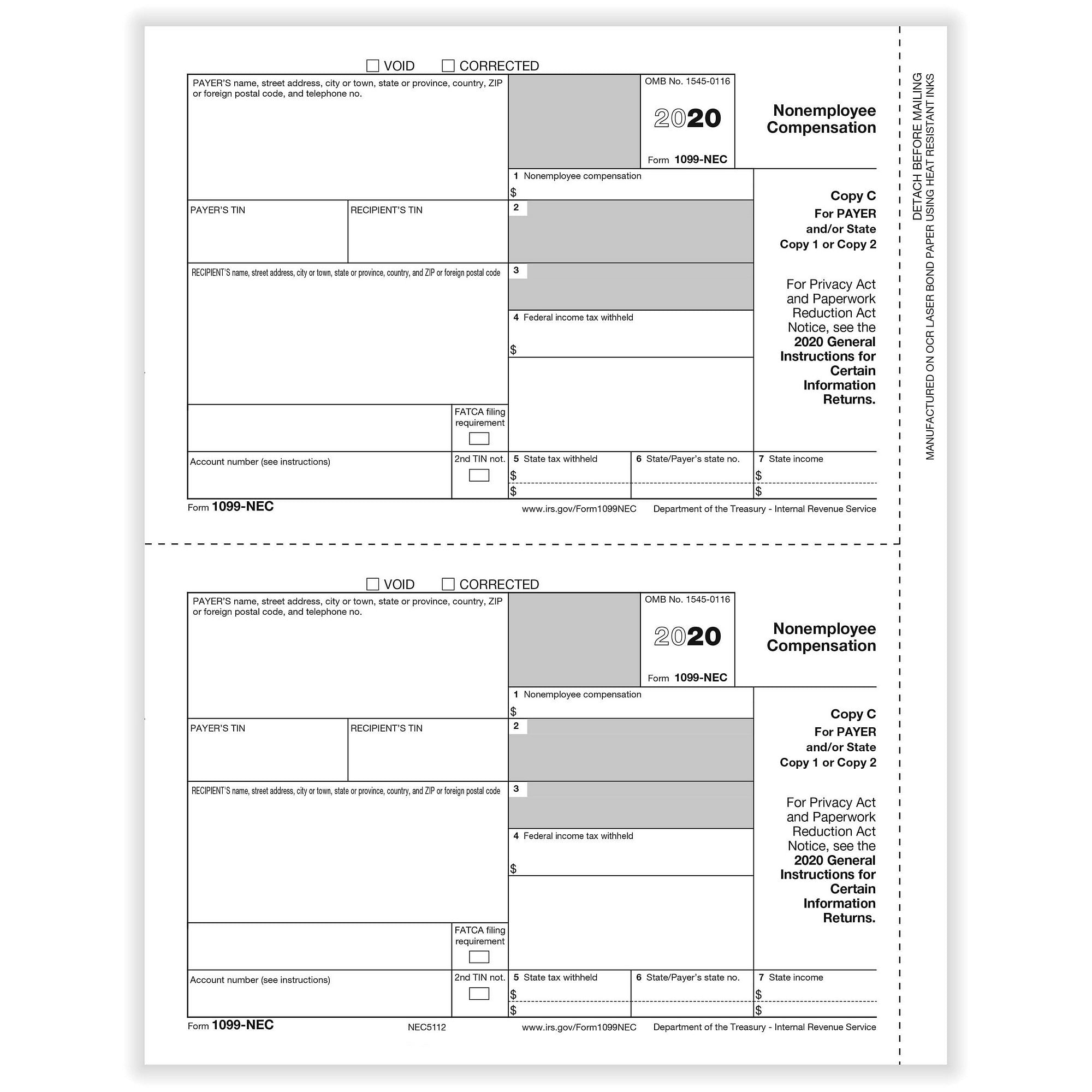

Form 1099NEC, Nonemployee Compensation Taxpayers who are independent contractors should receive Form 1099NEC showing the income they earned from payers who are required to file Forms 1099 The use of Form 1099NEC to report payments to independent contractors is new for The amount from Form(s) 1099NEC, along with any otherNov 11, · If an individual is paid $600 or higher in nonemployee compensation, they will be issued a 1099NEC for incomeThe IRS has reissued the form 1099NEC for the tax season to replace box 7 on the 1099MISC, which up until recently was standard for reporting nonemployee paymentsAny income appearing in box 7 of a 1099MISC prior to isNonemployee compensation is usually reported on a Form 1099NEC Enter this on the Add / Edit / Delete 1099NEC or 1099MISC Income screen The 1099NEC is

What Is A Schedule C Stride Blog

Form 1099-nec 2020 nonemployee compensation worksheet schedule c

Form 1099-nec 2020 nonemployee compensation worksheet schedule c-Form 1040, Schedule E,Jan 07, 21 · Update The IRS has released a new form specifically for "NonEmployee Compensation", which is the main pay type used by our clients on a 1099Misc The new form is a Form 1099NEC The rules mentioned in this blog are still in effect and can be applied to Form

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

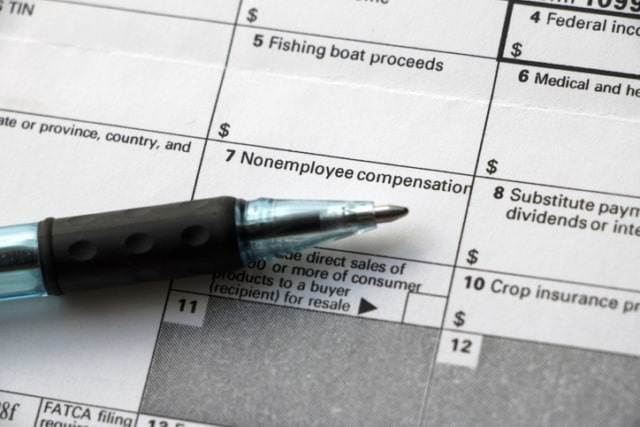

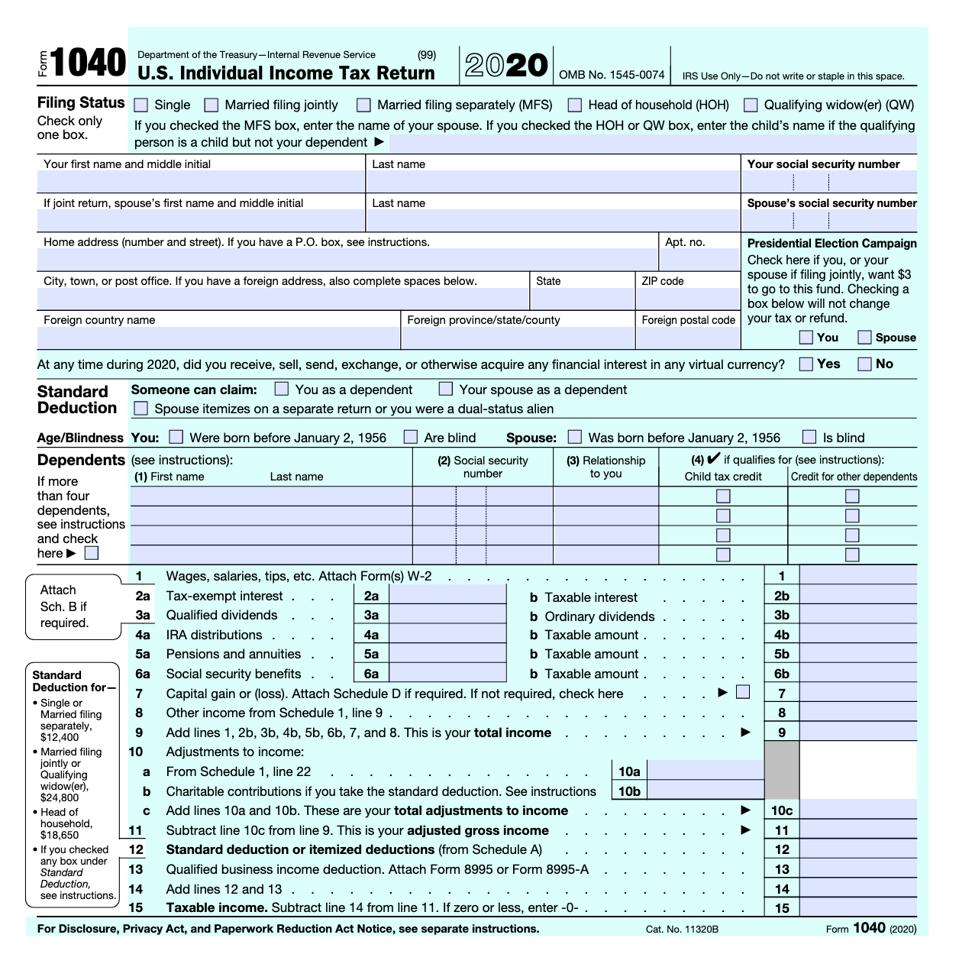

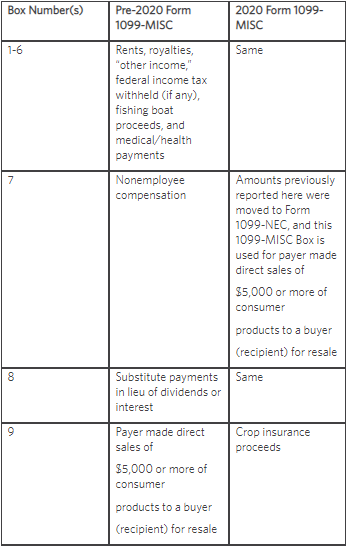

Form 1040, Schedule D, Capital Gains and Losses;All nonemployee compensation must be reported on the Form 1099NEC Nonemployee payments are any person or business you've paid more than $600 in a tax year in exchange for performance of servicesDec 30, · Previously, you would be including nonemployee compensation in Box 7 on Form 1099MISC, but now it is turned into "Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale" In , "Nonemployee Compensation" must be reported by using Form 1099NEC

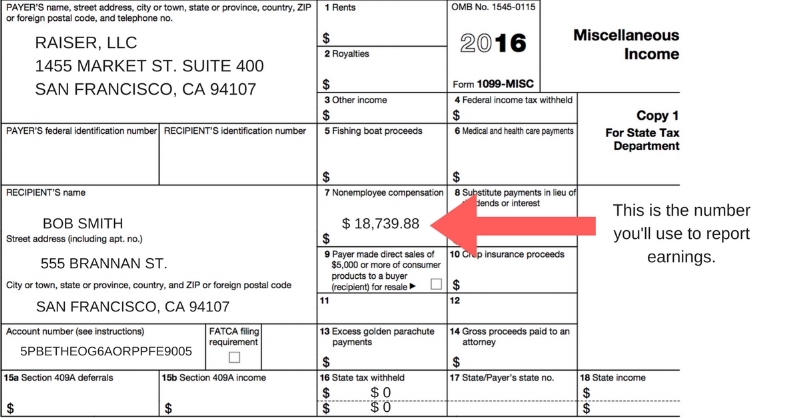

When you receive a 1099MISC with income in Box 7 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C If you are filing a 1099MISC with income in Box 7, you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099MISC entryForm 1099 NEC is the separate form to report nonemployee compensation to the IRS 1099 MISC Box 7 should report separately on IRS Form 1099 NEC If you made of $600 or more to an individual, then report it to the IRS by Filing 1099 NEC Tax FormMay 05, · The 1099NEC is a different form than the 1099MISC Form 1099NEC reports nonemployee compensation, whereas Form 1099MISC reports other miscellaneous income Starting in , businesses need to report nonemployee compensation on a separate Form 1099NEC in addition to any other miscellaneous income reported on Form 1099MISC

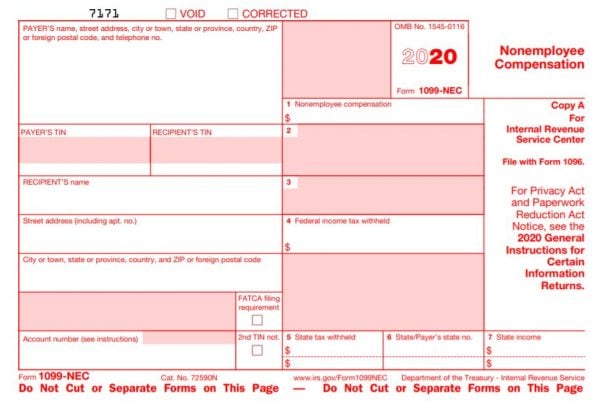

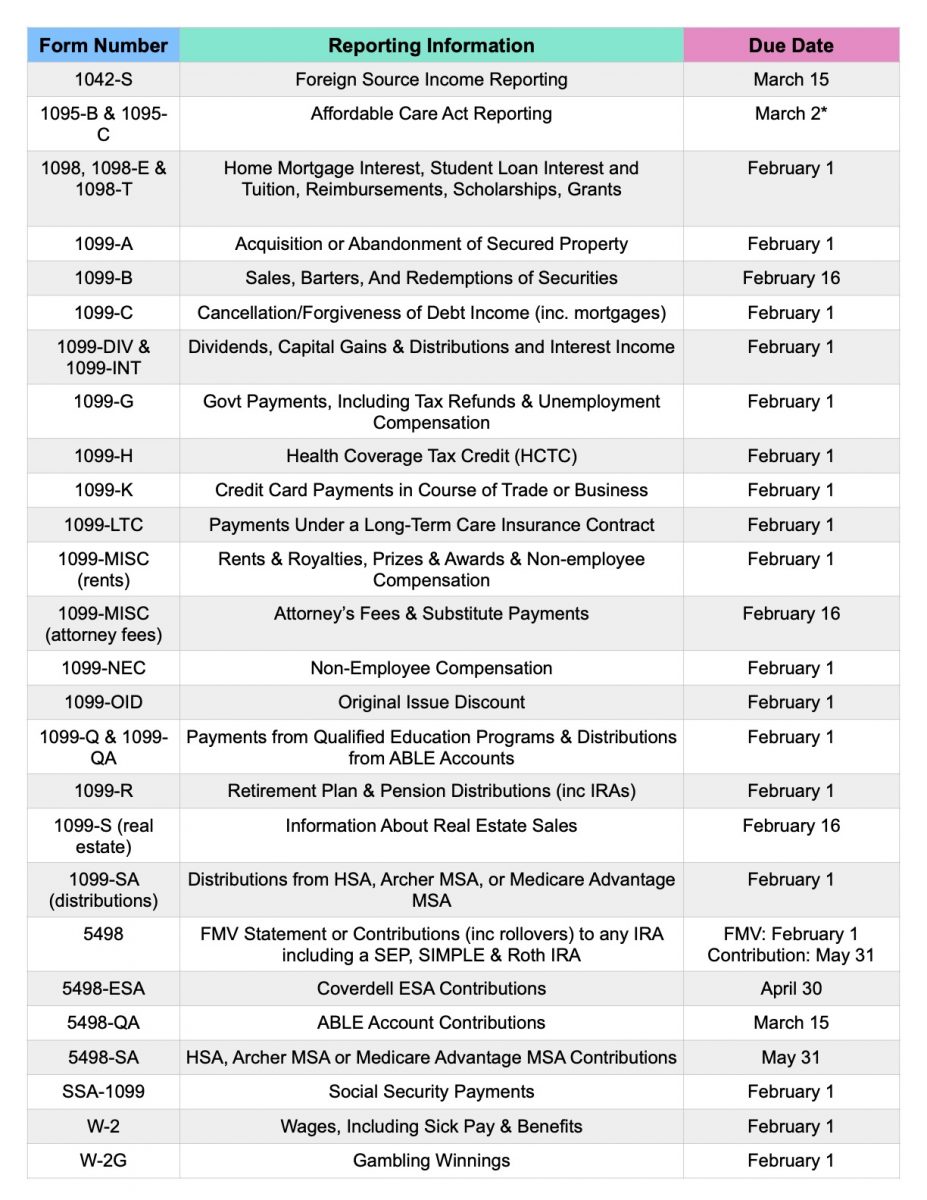

If 1099MISC was used to report nonemployee compensation, it had to be submitted before February 28 Two different deadlines for the same form confused many, including payers and vendors In fact, the IRS considered the returns late if they were received after January 31 To clear up this confusion, the IRS decided to relaunch the Form 1099NECBeginning in Drake, nonemployee compensation will be reported on Form 1099NEC, line 1, not on Form 1099MISC, line 7 More information may be found in Form 1099NEC Instructions Form 1099NEC is located on the General tab of data entry on screen 99NThere is also a link on the 99M screen, in the top left hand corner, that goes directly to the 99N screenNov 25, · IRS Form 1099NEC is filed by payers who have paid $600 or more as nonemployee compensation for an independent contractor or vendor (ie, nonemployee) in a calendar year The form must be filed with the IRS and also a copy of the return must be furnished to the recipient 2 Who must file Form 1099NEC?

Prepare To Issue New Irs Form 1099 Nec By Jan 31 21 Ohio Cpa Firm Rea Cpa

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Form 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 toMar 26, 21 · In addition to filing Form 1099NEC with the Internal Revenue Service (IRS) at the end of the year, several states also require 1099NEC filings for nonemployee compensation (contractor payments) We've broken down the requirements for each state, but make sure you verify your responsibilities by checking your state's website or speaking withFeb 22, 21 · Use Form 1099NEC to report nonemployee compensation Current Revision Form 1099NEC PDF Information about Form 1099NEC, Nonemployee Compensation, including recent updates, related forms, and instructions on how to file

1099 Misc Form Fillable Printable Download Free Instructions

The Impact Of Irs Form 1099 Rules On Lawyers And Clients New York State Bar Association

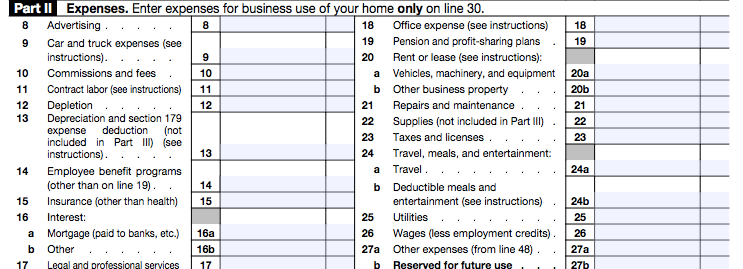

C Nonemployee compensation7 C, F Selfemployment income Starting in , this income is reported on Form 1099NEC Substitute payments in lieu of dividends or interest 8 8 1 Amount of $10 or more received by the taxpayer's broker as a result of a loan of their securities Payer made direct sales of $5,000 or more of consumer productsIf the Form 19 should not be present in the return and the Nonemployee compensation should flow to 1040 Line 21 as other income For instructions on this, see our solution on how to enter nonemployee compensation so it flows to Form 1040, Line 21 in a 1040 return using worksheet viewFeb 02, 21 · If you received the Form 1099NEC for a nonemployee compensation, you should enter the information in both Form 1099NEC and Schedule C sections I will suggest you to add the Schedule C See below for instructions You would start from the 1099NEC section under "1099MISC and Other Common Income"

What Is A Schedule C 1099 Nec

Taxbandits Payroll Employment Tax Filings Medium

Enter the Payer Information from Form 1099NEC Scroll down to the 1099NEC subsection Enter the box 1 amount in (1) Nonemployee compensation Enter the box 4 amount in (4) Federal income tax withheld Enter the box 5 amount in State tax withheld, and select the appropriate state from the dropdown menu Enter the box 6 identifier in Payer'sFeb 08, 21 · If you have not yet entered your 1099NEC, you will enter the Form 1099NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return Follow these steps to go to the Schedule C section of your returnThe IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7) To use the "reinstated" 1099NEC

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

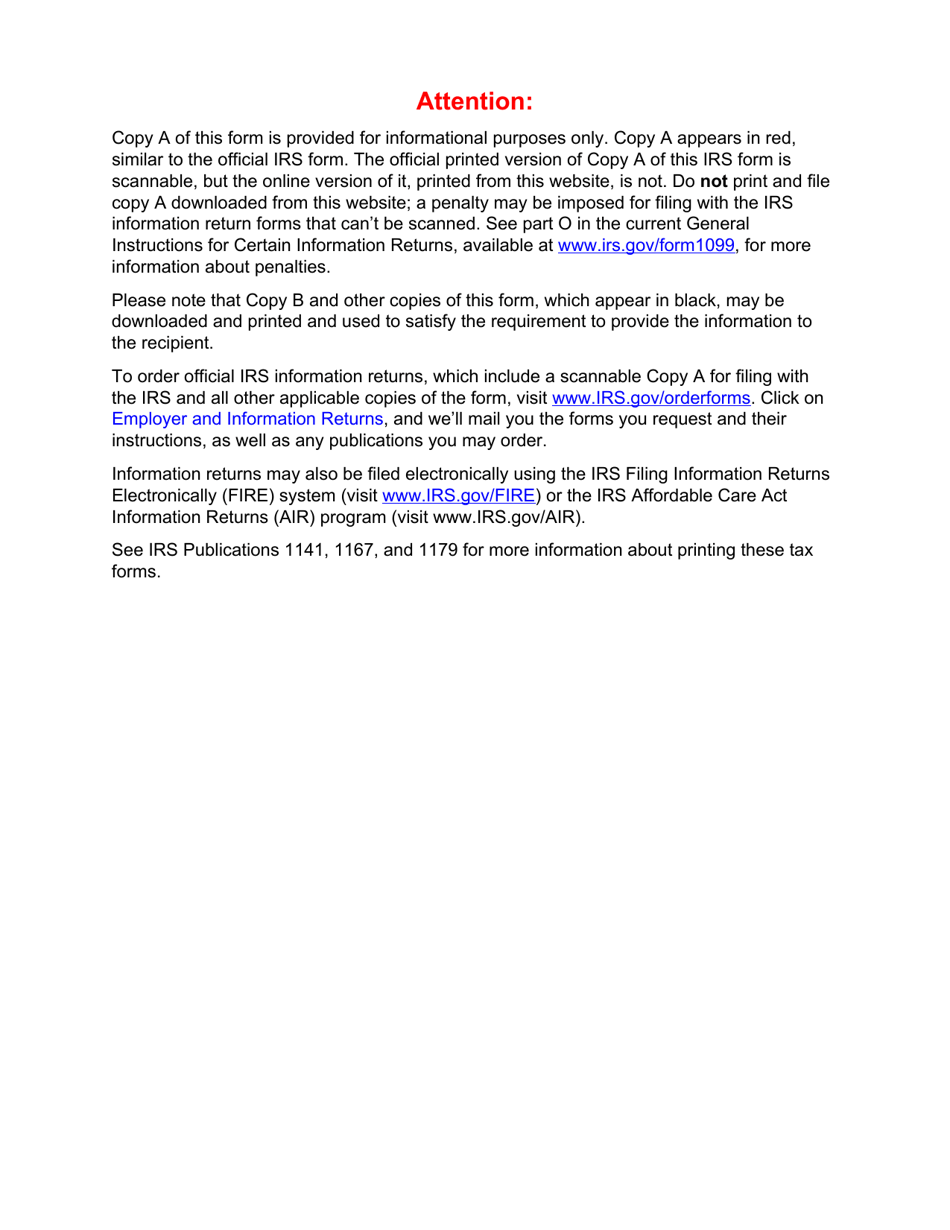

May 07, 21 · Download Form 1099NEC Nonemployee Compensation Here is a link to a downloadable Form 1099NEC for the tax year 21 Copy A of the form is in red;Aug 05, · Introducing IRS's New Form 1099NEC, Nonemployee Compensation By Brett Hersh Published , Edited 08// Share $25 OFF For video training featuring indepth information like this, purchase the 1099NEC & 1099MISC Training Course course today!The IRS considers any income reported in Box 1 of the 1099NEC as selfemployment income and looks for it to be reported on either Schedule C or F If you received a Form 1099NEC with nonemployee compensation but you should've received the income on a W2 , you don't need a Schedule C for your 1099NEC

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

What Is The Irs Form 1099 Misc And How To File It Cute766

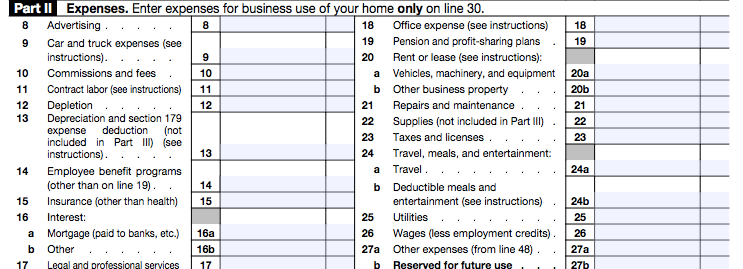

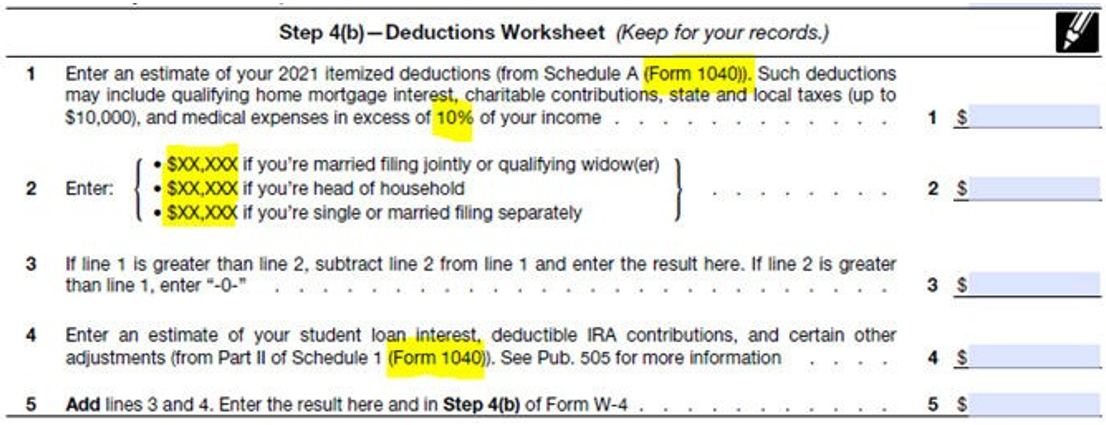

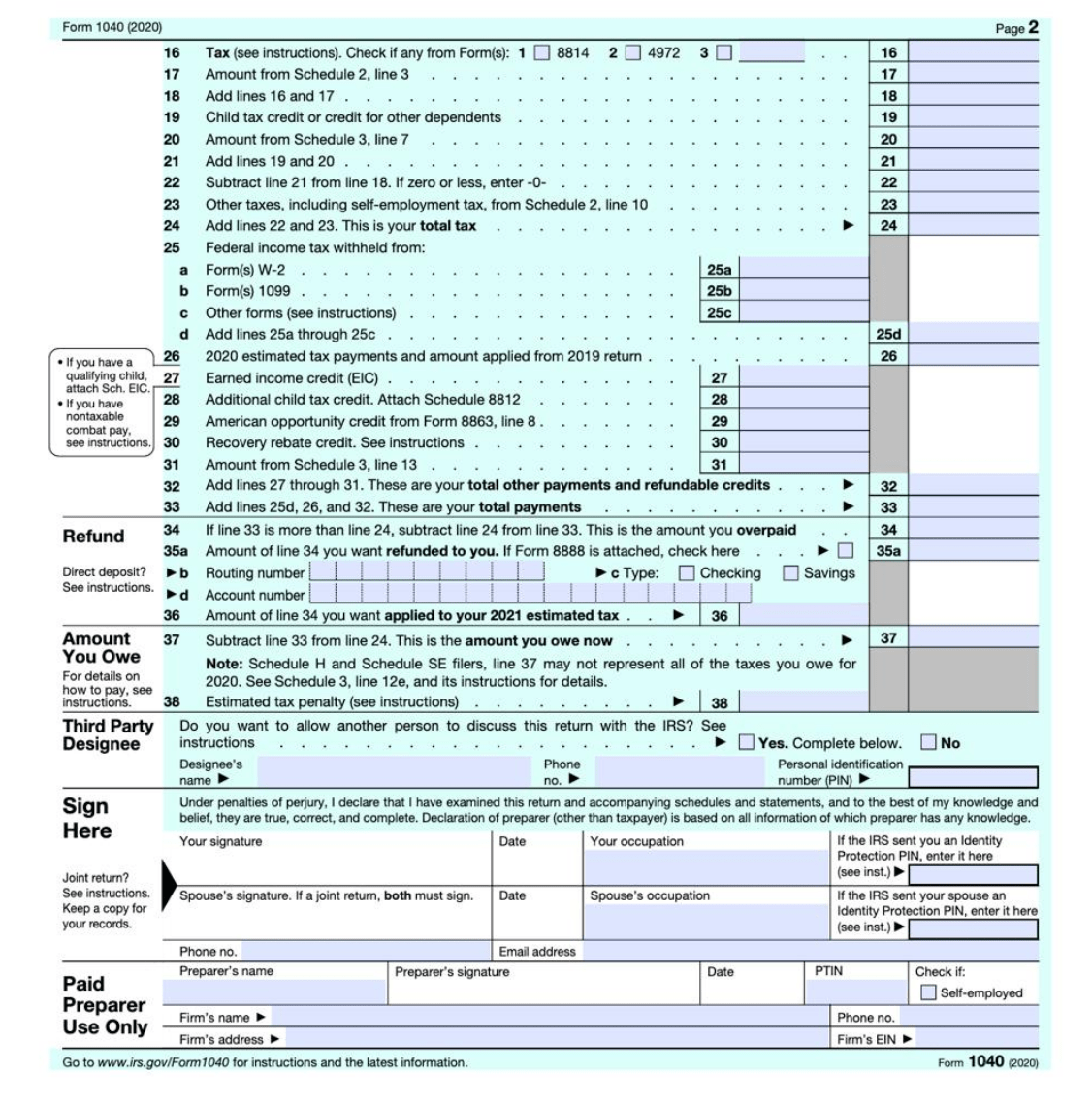

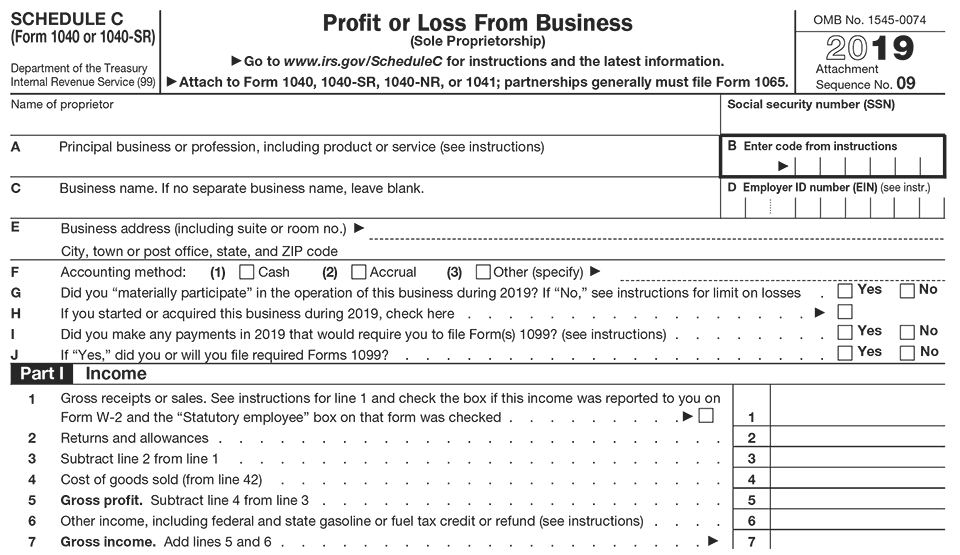

Jan 08, 21 · Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISCSchedule C, Profit or Loss From Business;Form 1099MISC Miscellaneous Income (Year ), SelfCalculating;

Form 1099 Nec Reporting Nonemployee Compensation Albin Randall And Bennett

Form 1099 Nec For Nonemployee Compensation H R Block

You can Create a new Schedule C or add the income to an existing Schedule C (same type of work) The income from the 1099Misc Box 7 or 1099NEC will be automatically pulled to the Schedule C If you have already added the 1099MISC/1099NEC in the program you will need to take different steps to associate the Schedule C to the 1099MISC/1099NECDec 08, · Until the early 1980s , the IRS required any compensation paid to nonemployees to be reported on a separate form, called Form 1099NEC Starting in 19 , though, a box was included for nonemployee compensation on Form 1099MISCFor the 19 tax year, nonemployee compensation was Box 7 on Form 1099MISC , but you'll notice there is no longer a space for it on that formForm 1099NEC Nonemployee Compensation (Year ), SelfCalculating;

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Publication 17 Your Federal Income Tax Internal Revenue Service

Download Fillable Irs Form 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Nonemployee Compensation Online And Print It Out For Free Irs Form 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal FormsFeb 11, 21 · Previously, businesses used Form 1099MISC, Miscellaneous Income, to report nonemployee compensation and a number of miscellaneous payments to vendors (eg, rent) Depending on your business activities during the year, you may need to prepare both Form 1099NEC and Form 1099MISC Form 1099NECMar 02, · The Internal Revenue Service (IRS) released its final version of Form 1099NEC, Nonemployee Compensation, on December 6, 19, to be used for reporting current and deferred compensation paid to

How To Report Backdoor Roth In H R Block Tax Software A Walkthrough

What Is A Schedule C Stride Blog

Nov , · Taxpayer ID Numbers for Form 1099NEC You must have a valid tax ID number for a nonemployee before you prepare Form 1099NEC When you hire a nonemployee, you must get a W9 form from them reporting this and other identifying information you'll need to complete Form 1099NEC Document your efforts to obtain a completed W9 form by keepingDec 14, · What is Form 1099NEC?May 11, 21 · Form 1099NEC Nonemployee Compensation is a form that solely reports nonemployee compensation You fill out a Schedule C at tax time and attach it to or file it electronically with your Form 1040 Compensation only needs to be reported on Form 1099NEC if it exceeds 600 for the previous tax year

Self Employed Vita Resources For Volunteers

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Dec 03, · Again, report nonemployee compensation on Form 1099NEC Nonemployee compensation typically includes fees, commissions, prizes, and awards File Form 1099NEC for each person you paid the following to during the year $600 or more in Services performed by someone who is not your employee (eg, independent contractor)Download Printable Irs Form 1099misc, 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Online And Print It Out For Free Irs Form 1099misc, 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal FormsLearn the rules to correctly report 1099NEC, Nonemployee Compensation, and the most

Ready For The 1099 Nec Schultz Group Cpas

Freelancers Meet The New Form 1099 Nec

How Do I Find my Form 1099 If you earn more than $600 in payments during the last year from the DoorDash app, then you will receive a Form 1099NEC Nonemployee Compensation from Payable In the past they would send a 1099MISC form, but the 1099NEC is replacing that formJan 29, 21 · Related 7 tax tips for your side hustle Important to note Starting tax year , Form 1099NEC replaces Box 7 on Form 1099MISC Form 1099NEC, Nonemployee Compensation, is specifically for selfemployed individuals, gig workers and other people who made income from a business outside the employee/employer relationshipIt is for informational purposes and Internal

Who Gets A 1099 Form Find Out If You Need To Pay Self Employment Tax Gobankingrates

The Amazing 1099 Checklist For Independent Contractors

Sep 17, · Form 1099NEC is used to report nonemployee compensation Compensation only needs to be reported on Form 1099NEC if it exceeds $600 for the previous tax year Nonemployee compensation was previously included on the 1099MISC formGenerally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employeeWhat types of compensation needs to be reported on Form 1099NEC?

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeFeb 05, 21 · This article will help you enter income and withholding from Form 1099NEC in ProSeries Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 To access the Form 1099NEC WorksheetThe nonemployee compensation reported in Box 1 of Form 1099NEC is generally reported as selfemployment income and likely subject selfemployment tax Payments to individuals that are not reportable on the 1099NEC form, would typically be reported on Form 1099MISC

Excel1099 How To File Form 1099 Nec With Excel Cute766

F O R M 1 0 9 9 N E C W O R K S H E E T Zonealarm Results

The 1099NEC (preview here) is a new form specifically for reporting nonemployee compensation—currently defined as payments to individuals not on payroll on a contract basis to complete a project or assignmentThis would include all independent contractors, gig workers, or selfemployed individuals who previously had their payments reported in box 7 of a 1099MISC formMar 03, 21 · The rules for Form 1099NEC are the same as they were for Form 1099MISC with nonemployee compensation in Box 7 It's just a minor paperwork change Generally, you need to issue a Form 1099NEC if you pay an independent contractor $600 or more during the year and the payment is not reportable on a Form 1099KJul 13, · Form 1099NEC is the new IRS form starting in , and it replaces Form 1099MISC for reporting nonemployee payments The IRS has released the Form 1099NEC to report nonemployee payments This move affects almost all businesses within the US who need to report nonemployee compensation

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

Businesses Get Ready For The New Form 1099 Nec Sensiba San Filippo

Form 1099LTC Long Term Care and Accelerated Death Benefits 1019 Form 1099MISC Miscellaneous Income (Info Copy Only) 21 Form 1099MISC Miscellaneous Income (Info Copy Only) 11// Form 1099NEC Nonemployee Compensation

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec Is New For Here S What You Need To Know

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

1099 Nec And 1099 Misc What S New For Bench Accounting

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

F O R M 1 0 9 9 N E C W O R K S H E E T Zonealarm Results

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Tax Forms Archives Taxgirl

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

E File Form 1099 Nec Online How To File 1099 Nec For

Understanding Your Instacart 1099

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Irs Releases Form 1040 For Spoiler Alert Still Not A Postcard

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Form 1099 Nec What Is It

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

Freelancers Independent Contractors Archives Taxgirl

What Is Form 1099 Nec Who Uses It What To Include More

1099 Filings For Landlords 21 Edition Deadline Chart

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

2zwxyerqyijfhm

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Form 1099 Nec Nonemployee Compensation 1099nec

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To File Schedule C Form 1040 Bench Accounting

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Federal Updates

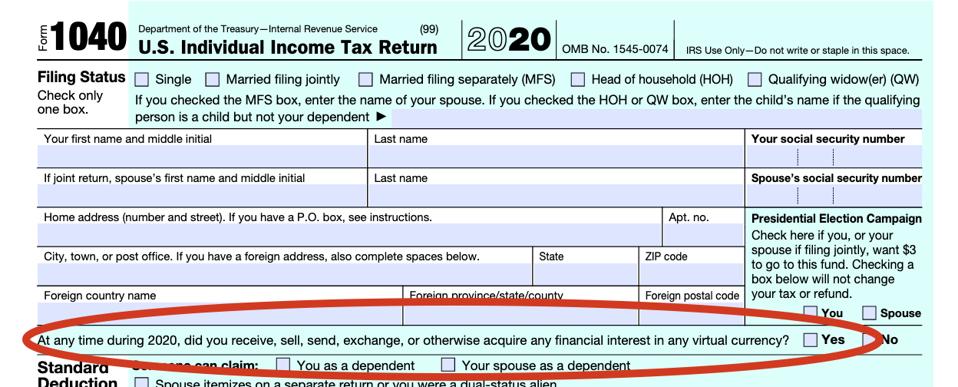

Tax Season 21 What You Must Know About New Reporting Rules Mystockoptions Com

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

1099 Nec Schedule C Won T Fill In Turbotax

Your Ultimate Guide To 1099s

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

What Should I Put Into The Blank Next To Schedule

Self Employed Vita Resources For Volunteers

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Tax Forms Archives Taxgirl

Tax Prep Dispatch What S New For Forms In Prosperity Now

Tax Return Forms And Schedules E File In 21 Or Now

Ready For The 1099 Nec Emc Financial Management Resources Llc

Taxme

Form 1099 Nec Nonemployee Compensation 1099nec

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

1099 Nec Conversion In

Tax Forms Archives Page 2 Of 3 Form Pros

Irs Releases Form 1040 For Spoiler Alert Still Not A Postcard

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Solved 1099 Nec Software Issue Page 4

Updates What S New For The 21 Tax Return Season Mystockoptions Com

1099 Nec Non Employee Compensation Payer State Copy C Cut Sheet 400 Forms Pack

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec How To Fill Out This New Form Youtube

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

What Goes On Schedule C Line 1

Freelancers Meet The New Form 1099 Nec

Form 19 Reason Code

0 件のコメント:

コメントを投稿